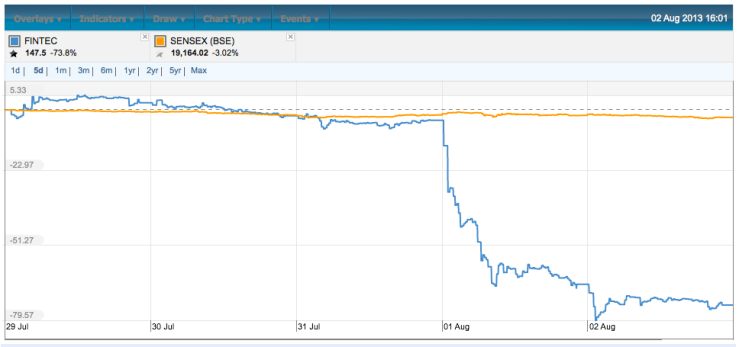

A story on Financial Technologies (a stock which dropped 65% yesterday and then another 20% today) in today’s Livemint mentions “warehouse receipts.”

QUOTE

What’s the fear?

That there is no underlying commodity is the fear. NSEL says it will sell the commodity and meet its payment obligations, but what if there are no commodities?

Surely, there are warehouse receipts?

Yes, but these have been issued by a group company and there’s no clarity on the presence of commodities.

UNQUOTE

Die-hard Warren Buffett fans would remember the Salad Oil Scandal involving warehouse receipts too.

In an earlier post on floats and moats I had re-told that story, but let me do it here all over again.

Warren Buffett’s Amex Story

The story starts in 1964. Warren Buffett is a young, dynamic investment manager and he is about to make his first big bet— a 5% stake in American Express. That’s 40% of his assets under management. Amex is embroiled in a scandal involving of things, salad oil.

Tino De Angelis, who is a convicted fraudster, is unable to get credit from a bank. So he comes up with a neat plan. Amex is a prosperous company with a stellar reputation. It also has a division that would specialize in “Field Warehousing”— a way for Amex to loan a business money based on inventory of goods and commodities.

Tino goes to Amex with many millions of pounds of very valuable salad oil and deposits it in one of Amex’s warehouses. Amex writes him a warehouse receipt, which he takes to a bank and uses it as a collateral to take out a loan.

There is a problem however. Tino’s “valuable salad oil” is actually seawater with no value. No one at Amex has bothered to check out Tino or opened the tank to see what’s inside. I guess there were issues with KYC even back in 1964.

Tino then takes the money from the bank and gambles it all away in— you guessed it— in commodity futures and options. He immediately files for bankruptcy. His bank goes to Amex with the warehouse receipt to recover his loan and oops do they have a problem when they open the tank containing sea water!

Amex discovers it has that it has a problem subsidiary. The extent of the problem? About $150 mil. That’s a very large sum of money in 1964. Amex’s Warehouse subsidiary files for bankruptcy but for Amex trust is everything. Its CEO says that Amex has a moral obligation to pay the bank even though its not legally obliged.

The market gets spooked. Amex’s stock drops from 60 to 35.

Ok, now let’s look at the magnitude of the problem— the way Warren Buffett sees it and the way the stock market sees it. First, from the market’s viewpoint.

As of the end of 1964, Amex’s consolidated balance sheet reveals that the company has no bank debt or bonds outstanding. Moreover the company has cash amounting to $263 Mil and a largely liquid securities portfolio having valued at $515 Mil. So, it appears that the loss of $150 mil on account of what now is being called as the “salad oil scandal” is not so huge that it can impair the company’s ability to survive and prosper. Until, of course, you look at $526 million dollars of travelers cheques outstanding and representing money taken by Amex in exchange of pieces of paper it has issued to millions of Americans which they can redeem for cash on demand.

What if there’s a run on Amex? The consequences could easily be devastating as the company would be forced to liquidate its assets to generate the cash to redeem half a billion dollars worth of travelers cheques.

Amex has not a missed a dividend in 94 years and now the stock market is pricing it for a potential insolvency.

We know that Warren Buffett disagreed with the market because over the next two years, he invests $13 million into Amex for a 5% stake and that is 40% of his partnership’s money. You don’t put 40% of you money into an idea unless you have deep conviction. So, what was Buffett thinking? Let’s speculate on that.

First, imagine that instead of $526 million of travelers cheques, Amex had bank debt of an equal amount outstanding. Would Buffett have invested? No. because the bankers would have immediately recalled their loans forcing Amex to get into a “fire sale mode” which could easily result in the decimation of its equity value. Clearly the bank debt of $526 million would be too risky but travelers cheques of the same amount instead, maybe not.

Second, how likely is that the millions of customers who hold the Amex travelers cheques will panic at the same time because of the “salad oil scandal” and will not only stop buying them, but will line up out Amex offices throughout the world to redeem them? Buffett goes investigating. He goes to shopping malls and observes customer behavior. He also asks an assistant to do the same in other parts of USA. Together they find that customers don’t care about the salad oil scandal and continue to buy and use travelers cheques.

The scandal’s tarnish is reflect in Wall Street’s valuation of Amex stock but has not spread to Main Street. He buys the stock.

He sells out by 1968 making a $20 million profit on his $13 million investment.

Is Financial Technologies (FT) another Amex Type of a Situation?

Unfortunately, no. Two key reasons.

- First, in the Amex situation, Mr. Buffett’s analysis showed that the problem subsidiary was not going to impair the core operations of the company. That’s not the case with FT.

- Second, in the Amex case, all of the liabilities were represented by travellers cheques issues to tens of thousands of people, most of whom didn’t even know about the salad oil scandal, or even if they did, they didn’t care. That’s not the situation with FT where its liabilities represent money to be paid immediately to a handful of brokers who very much care about the money they are owed by the company because they owe the same money to their clients.

If you bought the stock at its low price yesterday, using the “it-has-fallen-65%-so-how-much-more-can-it-fall?” “logic” you will be regretting your decision today.

There is no way a public market investor can intelligently estimate whether FT will be solvent or not a month from now. The needed information about the collateral behind those “warehouse receipts” simply isn’t there.

There are at least two more problems. First, when collaterals are sold off in a fire sale, typically they realise far less than their estimated value during normal times. The next few days for FT will not be normal.

Second, capitalism works on trust, and in an exchange business like that of FT, trust in the integrity of the system attracts buyers and sellers in the first place and their increased business volumes attracts more buyers and sellers and so a virtuous circle of “network effects” delivers the exchange owners with a moat. That trust now lies in tatters. So, even if FT remains solvent, its moat is now massively impaired, if not destroyed.

I have no position in FT or MCX or in any derivatives in either of these two stocks.

END

I fully disagree with your views……………. FT has no liability in its books as creditors belong to NSEL. If NSEL is unable to fulfill its obligations then the reputation of FT shall be severely impaired. But if NSEL honors obligation then FT will be preceived with trust in future…… Moreover price at which FT is quoting is much less than fair value of investments in its book…. Its worth taking the risk at current price in FT and MCX at CMP……. Even the dividend yield is very attractive in MCX / FT….. Market is perceiving that due to reputation loss volumes will dry in other exchanges promoted by FT….. See the turnover of MCX , IEX of last 2 days, is there is any significant impact of perceived default on other exchanges….?? More over , every body knows the culprit is GOVT….. not FT…and there are govt sponsored promoters and PE investors in NSEL as well…. So reputation loss is going to be very limited….. A great buy at current levels … both MCX and FT…..

I have not done much of work on FT, but what I can see based on a quick digging is that:

1. At current prices FT standalone is trading below net cash

2. The core business of FT is not exchanges but software for broking firm dealing desks. These firms buy the software and pay on an annuity model. Fairly high switching costs and search costs from what I understand and a sticky revenue stream.

3. NSEL is a subsidiary and even if it goes bankrupt NSEL’s creditors can’t come and ask anything from FT. It will just be a liquidation of NSEL.Or at least that’s what FT claims.

4. The earnings power of the software business is probably not going to be impacted by all this and they may even have the necessary collateral, in which case even better.

1. At current prices FT standalone is trading below net cash

Are you looking at FY13 cash, or cash as of now? Those two numbers could easily be materially different. Public investors do not know cash position on the balance sheet as of now. In financial firms balance sheets change very quickly and today’s balance sheet, which we don’t know, could very easily be very different from the FY13 balance sheet.

2. The core business of FT is not exchanges but software for broking firm dealing desks. These firms buy the software and pay on an annuity model. Fairly high switching costs and search costs from what I understand and a sticky revenue stream.

3. NSEL is a subsidiary and even if it goes bankrupt NSEL’s creditors can’t come and ask anything from FT. It will just be a liquidation of NSEL.Or at least that’s what FT claims.

Even if this is true, it’s wrong to assume that the liabilities of the subsidiaries will not haunt the parent. That’s because: (1) Guarantees given by the parent to the creditors of subsidiaries liabilities (see contingent liabilities schedule in balance sheet); and (2) Even if there were no such guarantees, there is implicit guarantee. If they don’t make up on those liabilities, they will suffer loss of reputation. And if you lose reputation once, it’s hard to get it back. In this business, reputation is everything…

4. The earnings power of the software business is probably not going to be impacted by all this and they may even have the necessary collateral, in which case even better.

When you say “probably not going to be impacted by all this” you are implying a very high degree of confidence. I don’t share that confidence because I do not know how much of the software services revenue comes from customers from outside the ecosystem of this group. To the extent the software revenues come from members of those exchanges which were promoted by this group, I don’t have that confidence.

New information will emerge which can dramatically alter the situation. We may witness resignation of directors (which would imply deterioration) or we may witness prompt liquidation of collateral to satisfy the claims on the company (which would imply improvement). At this time, there isn’t enough public information to make an intelligent investment decision that promises safety of principal first, and a satisfactory return, later (Graham’s definition of investing).

One last point I can’t avoid repeating. The real time balance sheet of this group is changing and is likely to change dramatically over the next few weeks. When you see an year end balance sheet on a date which is known to everyone in advance, there can be careful planning to not have too many outstanding balances on both sides of the balance sheet (routine housekeeping practice amongst brokers and banks). If you got a chance to look at the consolidated balance sheet as of now for this group, and compared it with the “planned” balance sheet as of 31 March 2013, you will be surprised to see how different they looked, even though we are only 4 months from that date. Drawing inferences from past, even recent balance sheets, while evaluating such dynamic situations in financial companies is akin to driving a car by looking in the rear view mirror…

Sir,

I was looking at their Q1FY14 investor presentation which has a balance sheet as of the quarter end. So to that extent, there is a risk of one month’s deterioration and future deterioration if they have to pump in capital into NSEL or any such thing. They have current investments of 1500cr and long term borrowing of 657cr. Other current liabilities of 294cr will have a component of current maturity of long term borrowing for which I don’t know the exact amount. In FY12, it was zero. Assuming roughly half of 294cr is current maturity of LT debt, they should roughly end up with 700cr of cash.

Contingent liabilities (guarantees of subsidiary loans) were substantial at ~670cr in FY12 (can’t find the FY13 AR).

Another interesting thing between FY12 and the Q1FY14 presentation is that NSEL has gone from a subsidiary then to an associate. So it is unclear as to how much exactly FT owns in NSEL. Clearly, they seem to have offloaded some stake to someone. The FY13 annual report would have helped in at-least getting a better sense.

A substantial part of FT’s revenue seems to be coming from MCX (~25%). So to the extent that there is a drop in volumes at MCX because of this there can be an impact on FT. People can shift easily from MCX which currently enjoys a very high market share to NCDEX.

So, to the extent we have the facts, it seems like quite a risky punt. Anything is fair game.

That NSEL is no longer a subsidiary of FT is quite interesting.

On Slide 23 of its 4th quarter FY13 presentation, FT discloses NSEL as a subsidiary. This document is dated 30 May, 2013.

On Slide 19 of its 1st Quarter FY14 presentation, FT discloses NSEL as an associate. This document is dated 30 June, 2013.

So, as per FT documents, sometime between 30 May and 30 June, NSEL ceased to be a subsidiary of FT.

Hmmmm….

However, in a letter to BSE dated 16 July, 2013, FT referred to NSEL as a “material subsidiary.”

The mystery deepens…

Why was NSEL de-subsidarised? When was it de-subsidiarised? Who bought the shares in NSEL?

Disclosure: I have No position in FT or MCX or any derivative position in either of these names, nor will I be having them in the future. My interest is purely academic.

Exactly. July 16th must be well after the insiders have assessed the magnitude of the crisis. There must have been some transaction between July 16th and July 30th and from what I can see this transaction has not been disclosed.

There is a possibility that an investigation throws up some allegations of criminality in this particular transaction, or not disclosing the transaction. Or at least, if they try to wash their hands off NSEL saying it is an associate, they may face a legal obstacle in doing so. I would conjecture that these are extreme measures taken to protect against what seem to be big problems. Even if they have legally protected themselves, they have probably earned the wrath of the regulators already – not a good thing in this business to have and could take some off balance sheet cash to get rid of!

On 30 July, FT announced that

“Mr. P. G. Kakodkar – Independent Director of the Company resigned from the Board & its Committees due to his ill health and he ceases to be the Director.

Source: http://www.bseindia.com/corporates/ann.aspx?scrip=526881%20&dur=A

Wow. The plot thickens. Mr Kakodkar retired as SBI Chairman in 1997 and might be pretty old, but he is also on the board of MCX, Uttam Galva Steel, and Goa Carbon Ltd. He still seems to be on the board of MCX and Uttam Galva, but has resigned from Goa Carbon citing personal reasons.

Business Standard has reported that the company has clarified some of the points raised above. See:

http://www.business-standard.com/article/markets/the-typo-that-unnerved-financial-technologies-investors-113080600938_1.html

Dear Sir,

instead of a firesale, why cant they take a collateralized bank loan based on the warehouse commodities, if any. FT/MCX has had high quality promoters wherein they built the whole infrastructure around an exchange as opposed to just the exchange. What is certainly disturbing is that they have broken the government rules and offered future contracts on a spot exchange. The other disturbing aspect is this problem could permeate into other exchanges if brokers let it seep from NSEL to their other exchanges. But the full potential extent of damage is known – around 5000 crores.

With no change in information over 2 days, if I bought the stock at 65% discount I shouldnt worry if it fell further unless I deeply fear insolvency.

Sir,

That is for FT but what is the role of MCX in this apart from being a subsidiary of FT.

I invested in MCX based on TOLL PLAZA business model (explained by you in one of your earlier posts). Going by whats happening in mkts let us analyse worst case scenario for MCX:

1. NSEL is dissolved however its an unlisted company and it may be purchased by some one else later

2. NSEL debt is paid off by FT and other promoters

Core business of MCX is commodity trading with 85% mkt share, yes it may come down to some extend lets say 42.5% (although there are no serious competitors).

However, in all our discusions we forgot to mention Mr. Jigesh Shah promoter of the Group. As mentioned in one of your earlier posts abt Ajay Piramal, business acumen of Biz promoter with good track record is also very imp. In this case Jigesh Shah has single handedly raised an empire from nothing. I dont know abt others but I feel he has great knowledge abt commodity and derivative mkts of India awa world. This experience of his would be very handy in nxt 1-2 years to normalise the business functions of MCX

In case of FT fails/loses business worst case for MCX would be selling of stake.

In case I have missed out somethig pls do let me know.

Regards

Karun Bir Singh Sandha

Karun,

Before drawing conclusions about MCX’s attractiveness or otherwise, we should keep in mind the following:

1. In the past, there have been significant related party transactions between FT and its subsidiaries and affiliates. What is current nature of the relationship between FT and MCX is not known to public market participants;

2. It is yet to be established if FT broke the law relating to short-sales but if it’s found that it did, the market’s fears that there is never just one cockroach in the kitchen may not be as unfounded as may seem to some people at this time;

3. People who do business with FT are often also the people who do business with MCX. If they got burnt by FT, would they continue to conduct business with MCX by taking the position that these two entities are legally different? (Recall Mark Twain’s cat who sat on a hot stove once did not go near a stove, hot or cold, again). We don’t know the answer to that yet; and

4. In such dynamic situations, there are always people who know more than public market investors. Indeed, the public market investors will be the last one to find out the facts. That makes this game very dangerous for public market participants.

I know there is a tendency to assume that this is a case of Munger’s “pavlovian misassociation” where the baby (MCX) is being thrown out with the bathwater (FT). But, I urge anyone who has tendency to force himself or herself to come up with 3 or 4 reasons why he or she could be wrong. Instead of looking for evidence that will confirm one’s prior notions (in this case the belief that MCX will not be affected by FT’s situation), the four points I listed above forces one to get out of this confirmation bias.

It may well turn out to be the case that MCX is cheap, but there is no way (at least for me) to be sure (or even reasonably confident) about that based on information available to me today.

MCX, except for having common promoter will not have any obligation for NSEL payments. So the fall in MCX price is an oppourtunity to buy?

Sorry sir for the dumb question! But, who is the fraudster Tino De Angelis here?

Being an exchange if sellers have sold the underlying to the exchange and exchange is doing this business without veryifying the underlying, then the entire business model is dumb one. Isn’t it?

I thought the exchange only facilitated the buyers and sellers and if sellers don’t have the stock then shouldn’t get paid. Similarly the buyers if they don’t get deliveries of stock should get full refund.

With the brokers saying they don’t have any liability, I wonder who is at the receiving end here?

Lastly, I still fail to understand why they had suspend the contract trading even if the volumes were low.

Thanks in advance if somebody really throws light on the entire situation as media is all over the place and confused and confusing everyone :).

Fully agree with your “it-has- fallen-65%-so-how-much-more-can-it-fall?” logic. For minority investors its difficult to make intelligent decision or guess about the collateral damage from the recent events. From the recent episodes what I have learnt is if some stock falls more than 60%-70% in few days then better to wait for clarity…I think market generally gets it right and before getting arrogant and saying market is wrong and we will go ahead and buy what everyone is selling, we need to be much more clarity….

Institutional dumping of shares (also ability to short in F&O) can create massive anomalies in spot price/value sometimes. And price falls of this magnitude are rarely without reason – the real question usually is if the business disturbance is temporary and surmountable, and therefore being mispriced, or if it is a permanent one & therefore fatal.

While it is fair for you to say that “There is no way a public market investor can intelligently estimate whether FT will be solvent or not a month from now.” — is it fair for the market to conclusively assume the opposite is true i.e. is the 73% fall (Financial technologies) justified, or is that also like throwing a dart in dark? What gives them this confidence??

The market reaction appears to suggest that they know “for sure” that this company is ‘practically’ insolvent. The reality is that, maybe we just don’t know either way. So, while it may require a leap of faith to buy this ‘call option’ here, it is equally big (if not bigger) leap of faith to decimate the equity by 73% in 2 days.

Think about it!

what about risk and reward ? and taking 1% or 2% position ..if it works, well and good and if not, still not loosing much of my money ?

I would like to draw Parallel with Satyam episode for few of the comparisions done till now in this thread.

Similarities –

1. Satyam also a very strong franchise and in top 3 at the time the scandal broke

2. Had sever issues with Balance Sheet & Prompters at the time the issue came out

3. Stock was dumped super fast and reached levels of 7 rs.

Though UPA2 failed bitterly, they have couple of success stories. One was the way in which they handled Satyam in crisis and brought it along slowly and now it is back paying dividends.

And even in this case, Government has to come to resuce them because of the sheer size of MCX’s monopoly and stake of Government in the companies. Also confidence of financial system and investors is at stake to a good extent.

Differences –

The big difference between the Satyam and FinTech would be the nature of sectors. FinTech,MCX,NSEL and all deal in heavy amount of providing guarantee for cournter part risk and charging some amount of same along with their proven technology platforms for exchange trading.

Satyam was in IT sector, India’s golden sector with high stake in reputation of India across the globe and it dealt with around 1+ lac jobs.

Every moment will keep unfolding the fate and those who want to make maximum of this situation shall hunt for Truth at all cost.

When you mix loose regulatory framework with Incentive caused bias, what you get is an amazing human ability to cross all possible levels of morals and ethics.

I know this coz I have seen this manifesting in my school days. When the teacher is gone, those guys (me included) from a well to do family otherwise well mannered turn into STRAY dogs.

Fighting, barking and snatching all for an incentive to impress either the opposite sex or marking our territories.

Animal spirits come to the fore when the regulatory framework is loose and when there is an incentive to outperform.

This is the reason why Charlie Munger does not like Donald trump that much.

Entrepreneur par excellence who excels in non regulatory frame work

A recipe for disaster.

As for value buying is concerned. FT falls in the category of a falling knife and people with wrong anchors (52 week high low, % fall ) will flock here

Disclaimer: I shorted the stock on news and got out the same day. It was a one way street too tempting to miss.

Also thinking of making a straddle,(although Implied volatility is off the roof) something gotta give when nsel tells them that the warehouse receipts they are holding are actually tickets to a movie named ‘fantasy’.

“Timely” post. fascinating discussion..a case study with lots of opportunity to learn..

Prof, there could be a thousand problems with the Company..some actual, some perceived about whIch we simply dont know given available public information. Integrity of promoters could be questionable..

but surely there has to be some price at which u’ll say may be there is some value.

If it has fallen 80% in 2 days, say it falls another 50%(it is available at 10% of price on day 1).

What are ur thoughts, is there a price point where we are SURE about SAFETY OF PRINCIPAL and then may think of returns or do we simply say I do not have enough information. I am unsure of promoters integrity. so true value is ZERO.

price is everything. price changes everything.

isn’t it?

Thank you for the post! I agree with you. There isnt sufficient information. Only time will tell. I am less convinced than I will sound. But, here is how I am looking at it. I am mainly focusing on implications to MCX. Because I think its less on the hook than FT, a more well defined business, and there are incentives for influential players/stakeholders (govt + financial institutions) to not see it fail. I agree that not seeing it fail is different than wanting it to succeed.

FT owns 26% of MCX. That is, 74% is owned by others. Mainly financial institutions. It seems unlikely that MCX will pay for the shortfall. But, stranger things have happened.

It is claimed that NSEL has an open position of about 5400 crs. Assuming, this is correct and all of it is salt water. The worse case liability is 5400 crs. But very likely atleast some of it will be good.

When the dust settles, one of five things will be true.

1) There will be no shortfall. This seems highly unlikely.

2) FT has sufficient funds (as part of liquid assets) to meet this shortfall. i.e. shortfall less than 30% of open position at NSEL.

3) FT sells part of MCX and/or other assets or raises debt to meet excess short-fall beyond liquid assets.

4) NSEL defaults fully or partially. Which causes a significant erosion of trust.

5) There are more cockroaches. MCX has the same or similar problem as NSEL.

One argument is that regardless of the outcomes, the damage has already been done to MCX. But, if you think that the damage hasnt been done yet, then you would have to worry about 4 or 5.

Assuming the damage has been done, the question then becomes – is this damage permanent? One could argue that under the first 3 cases, the damage will be a temporary phenomenon.

But, that is an unknown, and almost impossible to predict. As one behavior depends on other people. A recursive definition. There is very little incentive for one or two brokers to move, its almost punitive for the said brokers in that situation. The prefect situation for the brokers involved would be if all of them collectively decide to move at the same time. Its almost a variation of an interative multi player prisoners dilemma .

About case 4 the neutralizing factors from MCX shareholder perspective, a) there might be switching costs associated at the clients end. b) there may be technological/operational issues on the other exchanges. c) it might be in FT’s interest to distance itself from MCX. and do so publicly d) the prisoner’s dilemma problem and dis-incentives for one player to move e) mcx claims a wide distribution network of terminals, not sure what the competitors landscape is.

I dont have data to claim any of the above neutralizing factors are actually valid. I would be grateful if some of you can invalidate(or validate) these points.

About case 5, it seems that there was a regulatory gap and NSEL over-reached to gain market share. I am assuming that such issues are unlikely in MCX given that this market isnt un-regulated. I might be wrong.

I personally think 1 and 5 are unlikely.

I hold no positions in FT or MCX. So, that hasnt biased my outlook.

What was going on was badla financing the commodity buyer by financiers who accepted 2 way contract of purchase (now: today) and sale (later: 1 month…)! If these obligations are not met and the financiers don’t (can’t) agree for rolling over you have a default at hand!

If its pure money lending (through the the fiction of commodity transaction), isn’t it easy to close the contract and recover the money from the borrower. If there is actual commodity transaction then the comes the issue of liquidation, quality, market price etc. from the buyer

NSEL just issued a press release. Looks like the issue is more manageable, although the payments could be more drawn out. The loss of reputation and its consequent negative impact on exchange volumes seems harder to tell at this stage.

NSEL press release below:

————–

Proposed settlement cycle

Mumbai 4th August’2013:

As per circular issued by the Exchange, the Exchange suspended trading and merged the settlement cycles of all one day forward contracts (other than e-series contracts) on 31st July, 2013. The said action was taken due to certain abrupt structural changes in the market place leading to disruption. This situation was aggravated by the loss of trading interest, due to uncertainties leading to trade in-equilibrium. However, the Exchange is fully committed to ensure proper settlement of all outstanding obligations and to comply with the directions issued by the Government in this regard and to settle all issues as per Rules and Bye laws of the Exchange.

Mr. Anjani Sinha, MD & CEO of the exchange stated that in the interest of arriving at a consensus and satisfactory solution for settlement of dues in accordance with Exchange Rules and Bylaws, he held various meetings with the Members of the Exchange and the buyers/ processors. These meetings were also aimed at ensuring avoidance of any incidence, which may have consequential impact on larger market. He also held meetings with the Forward Markets Commission (FMC).

He expressed confidence over handling large quantum of pay-in /payout obligation at the same time. However, in case of declaration of default by any member, which would lead to a long litigation process, the following options have been proposed and the final decision would be taken after due consultation with all stakeholders.

Option 1:

A. There are 8 members/ processors, who are willing to pay as per the scheduled due date or even earlier. The total amount pertaining to such 8 members is Rs. 2181 crores.

B. There are 13 members/ processors, who have offered to pay 5 % of their total dues every week, if the same is agreed upon. Total amount comes to Rs. 3107 crores approximately. Name of such members are as follows:

Sr No

Name of Party

1

Jugger nautes Projects Ltd

2

MSR Food Processing

3

PD Agro Processors Pvt Ltd

4

Shree Radhe Trading Pvt. Ltd

5

Sankhya Investments

6

Spin cot Textiles Pvt Ltd

7

Swatik Overseas Corporation

8

Topworth Steels & Power Pvt Ltd

9

Vimladevi Agrotech Pvt Ltd

10

N K Corporation

11

NCS Sugar

12

METKORE ALLOYS & INDUSTRIES LTD

13

ARK Imports Pvt. Ltd.

C. There are 3 processors with whom negotiation is still going on. The amount pertaining to these parties comes to Rs. 311 crore.

1

NAMDHARI FOOD INTERNATIONAL PVT LTD

2

NAMDHARI RICE & GENERAL MILLS

3

LOTUS REFINERIES PVT LTD

Option 2:

The exchange is in possession of Post dated cheques (PDC) from various processors amounting to Rs. 4900 crs. against their settlement obligation and balance parties have confirmed payment regularly. While PDCs are a commitment, the payout process may not roll out smoothly in a month’s time. Hence, the market participants have proposed Option 1 as a safer alternative.

FMC Officials have also asked for details of Members, Planters and other participants who are not cooperating with the Exchange in resolving the matter related to settlement cycle. The FMC along with other Government agencies would work together to ensure a safe and secure settlement of dues.

[…] Financial Technology Crashed Almost 75% in the past week erasing more than 1700Cr of the Market capitalisation of the company. Here is an excellent coverage by Deepak Shenoy in his blog Capitalmind.in . Also, an excellent article by Prof. Sanjay Bakshi explaining the difference between the crash that happened in AMEX and FT. […]

Ah. Thanks a ton for writing again. The web missed you.

Terrific post by Prof. and smart comments by all

Your blog has been linked to the Wikipedia page of National Spot Exchange https://en.wikipedia.org/wiki/National_Spot_Exchange#Crisis

It’s impossible that FT is a growth stock working in a profitable manner. Even if all the exchanges it owns start contributing to the bottomline, the hidden liability of regulation risk would be a risk that one cannot sleep with. These exchanges are not just in India.Most of the years, FT has made a bottomline loss because of it’s expansion and stake in many subsidiaries. So the intentions of promoters of focus on RoCE cannot be seen. AMEX was a growth stock. People were going to use AMEX services even 10 years down the line. So the intrinsic value calculation would have been easier. How does one calculate the intrinsic value of FT, a company which is growing because of 2 reasons: Non linear revenues from the software services and the non current investments in various exchanges? So even if things workout properly, the maximum upside that can be expected is the amount by which it fell because of the NSEL ban. But similar is the extent of expected loss if FT has to face a liability. So, it would be reasonable to invest only if FT is a growth stock. Otherwise, the risk reward ratio is not in the favor of an investor. This is to the extent that I can think.

I haven’t understood your questions. Please write clearly. Your comment is incoherent (at least for me).

agreee sir even i thought so, alas it was too late. i have wrote a better version which i would like to mail you. you may delete my comment now… many many thanks sir !!

Hello Prof, thanks for this excellent post. After going through the comments and various “uncertainties”, I have to ask one question – if a situation arises that FT has to sell controlling stake in MCX to an outside party to raise capital and settle NSEL issues, what is the likelihood that in such case, MCX will thereafter be treated as a separate entity, and the risk of reputation loss for MCX alone in that case will be minimized? This is also in benefit to survival of FT group as MCX can then continue to (or clinch back) the leader position in commodity exchange and continue generating revenues for FT?

What’s your opinion, if this “positive black swan” event occurs, will it make MCX a great “bargain” investment right now? of course, this would be treated as a special situation (similar to United Spirits (USL) that I can recall from recent past), since many outsiders will be interested to buy stake in MCX like did Diageo and when that happens, MCX stock prices can see a move like that happened to USL

Pls share your comments on this aspect of the MCX situation.

Sunny,

In my view, the best thing for MCX’s minority stockholders would be a change of ownership and board, and quickly (like yesterday). The controlling stockholders, however, may not want that to happen because that may not be in their own interest and self-interest drives most humans.

While I agree with you on the consequences of such a change, I have no idea about the probability of its occurrence. And since you call that event a “positive black swan” then by that definition, you implicitly assume it to be very very unlikely.

So, assuming that it’s very improbable that the above desirable change will happen (your implicit assumption— I don’t have a view yet), why would you want to buy the stock now? So, think carefully about that probability estimate instead of focusing only the lovely outcome!

Disclosure: I have no stake in FT, MCX or any of their derivative positions, nor do I plan to have any.

The board of an exchange has to be “fit and proper” to manage it. Post NSEL fiasco, it is only a matter of time Mr Shah and his other fellow board members of NSEL would be considered unfit to hold a board seat on any other exchange. So it doesnt matter whether it is in his interest or not, the MCX board will eventually have to change. FMC has already termed the NSEL board as not being fit and proper in one of its communications to the NSEL management.

Thus most probable scenario playing out would be:

1. NSEL board would be declared as unfit.

2. As Mr Shah and other fellow directors are declared unfit to hold a board seat on other exchanges, they would have to vacate their position in MCX Board.

3. Mr Shah would try to bring in his own candidates on the new board of MCX.

4. At this point, I feel, Institutions would play a more activist role (post NSEL fiasco confirming their doubts about Mr Shah) and block any backdoor representation of Mr Shah on the Board.

http://www.fmc.gov.in/show_file.aspx?linkid=Letter%20dated%2020082013%20to%20Board%20of%20Directors%20of%20NSEL-501977106.pdf (refer point 6 in the letter)

Regarding the Moat of MCX, the commodity volumes in MCX have not dropped yet in-spite of the news-flow (drop is only on account of CTT). Gold and silver are not even traded on NCDEX. And look at the bid-ask spreads on NCDEX for crude. What more loss of trust can there be? Brokers derive 30% to 40% of their revenues from commodity volumes. Traders just do not have an alternative but trading on MCX.

Also, the only chance for brokers to recover money from Jignesh Shah is by getting him to sell MCX. And the brokers will not screw the only asset through which they have some chance of recovering their money.

Rohan,

You listed the “most probable scenario” in your mind. That’s good.

What’s the probability percentage of that scenario? Going by this its between 75% and 93%. Would your definition of “most probable scenario” fall in that range?

Next, what are the consequences of that scenario panning out? A stock price of Rs 500? Rs 1,000? More? Less? How much?

Next, what are the other scenarios? Can the stock go down from here? Under what circumstances? We know the combined probability of all the other scenarios has to be somewhere between 7% and 25% if you agree with Kent’s thinking on the subject.

Next, what will be the consequences of those scenarios panning out?

Next, based on this analysis, what is the expected return?

Finally, how long will all this take? And how does that return compare with other opportunities available to you?

Keep in mind that opportunities to compound money at 20% p.a. for a long long time, may be far better than opportunities to make a quick buck in the short term (ignoring the “excitement” returns one gets in such situations).

All of this doesn’t mean that MCX is not a great investment at its current price. I don’t know if it is or not. But the above framework is necessary for evaluating this or other similar situations.

Sir..thank you for your reply..I do agree that I risk assigning unjustifiably high probability to an event that I believe is likely..and thus, if I think that there is a 60% chance of this event happening, then what are the events that could occur if the other 40% materializes:

some low probability events, to which I could be wrongly assigning “zero” probability (it is low but not zero):

a, this is the best chance for NCDEX to break the moat of MCX. If it can do it ever, it is NOW. It can try to break the trust of members of MCX and attract the members towards it. But, if the trust was to be broken, it should have happened by now. People who trade on MCX seem to be paying no heed to what is happening on NSEL, atleast for now. But, NCDEX would give its best shot!

b. while we believe that there is nothing wrong with MCX, we can never be sure given the ulterior motives of the promoters that have come to fore wrt NSEL. We just believe that because the exchange is regulated, everything is fine. But, regulators in our country are not particularly known to be very effective. As Buffett says, “there is never only one cockroach in the room”.

c. Thirdly, what happens on MCX is largely speculation with very low volumes being done towards hedging. So, what is the economic value addition of this exchange to the country. It is more like an online casino. So, regulations can come down very heavily on it to reduce volumes. However, the other side of the argument could be that speculators are important to give depth to the market and if one drives away speculators, genuine hedgers might not get a counter-party.,

So, yes – these are the worries. We can use these risks to determine the portfolio allocation that one wants to assign.

Exchange Business would classify as among the strongest moat a business can possibly have. And if MCX emerges out of this crisis, it will be much stronger. And then the investor community would be convinced of the moat reasoning that if a crisis of this magnitude cannot break it, then nothing can.

It is a Test of Moat. Only time will tell!

Regarding whether MCX can be a consistent 20% compounding kind of story, I agree with your reasoning that it can be a 2-3 bagger from the current price but might not be a compounding machine. To make a case for a serial compounder, we would should have foreseeable consistent growth.

a. Volumes in MCX can increase only on account of two reasons a. Increase in members and b. Increase in commodity volatility c. allowing Banks, Institutions to participate. I think increase in members is extremely difficult as the market seems penetrated (think there would be no broker who is not a member of MCX). Predicting volatility in commodities is next to impossible. So, the only predictable way in which turnover would improve is passing of the FCRA bill allowing participation of Banks, Institutions and allowing options. But given the mess, it might not happen very soon.Thus, it is difficult to make a case for long-term compounding in MCX.

Again, thanks a ton for replying!

Interesting observations by Rajeev Thakkar on MCX and FT, just thought of sharing for the benefit of people following this story…..

Rajeev Thakkar shares his view on FT and MCX. In both the main issue according to him is TRUST. He thinks FT is strictly not a buy. MCX might be yes or no depending on developments, more like a lottery [Though he adds he does not have any strong positive/negative view on MCX]…. [see the video from 38:00 http://www.youtube.com/watch?v=Dxq3hjjsdaY&list=WL590211560AC80BD0%5D